NewPlacement AG

Your career booster for over 30 years

Your future. Your success. Our mission.

We support specialists and executives with strategic career advice and individual outplacement to help them find their next top job—discreetly, purposefully, and effectively.

Private customers & businesses

Individual

1:1 coaching

Successful on the market for 30 years

Received a termination notice or experiencing a career standstill?

From working with many of our clients, we know how it feels to have to prove yourself again on the job market after a long time.

Success in the job market is not a coincidence — it's a strategy!

Our consulting services, with a success rate of nearly 100%, are based on a unique combination of individual success factors.

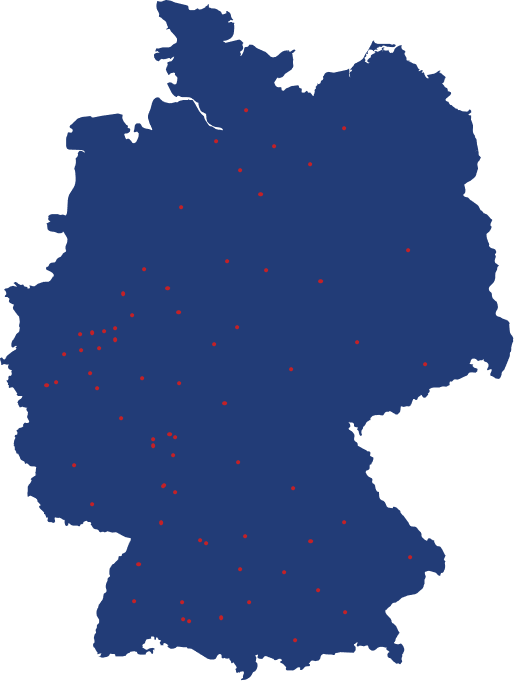

“Our senior partners provide consulting services throughout Germany, Austria, Switzerland, France, and the Benelux countries. We operate in more than 60 locations and offer our consulting services in four languages: German, English, French, and Spanish.”

Many thousands of people have found new jobs with NewPlacement

Dr. Roland S. (52)

Head of Development, Chemical Industry

Ute N. (42)

Head of Human Resources, Group Subsidiary

Andreas T. (49)

Managing Director Mechanical Engineering

NewPlacement reduces your search time and significantly increases your success rate.

✓ Tailored application documents

✓ Optimization of social media profiles

✓ Preparing for job interviews

Get access to our network and the hidden job market

Exclusive access to the industry network & benefit from the coaches' contacts.

Hidden job market

The hidden job market comprises jobs that are not advertised publicly but are filled via headhunters.

Inverse headhunting

Inverse headhunting means that we search for suitable positions for you at companies.

Benefit from coaches with experience in business practice

Our coaches have worked for many years in various companies and are familiar with companies, people, and processes.

We are not only coaches with extensive consulting experience, but also bring our management experience from corporate practice to our consulting work.

Personal consultation at a location near you

Nationwide presence: Advice at a location near you

Boutique character: Exclusive service without mass processing

Individual support: Your personal advisor takes the time to understand your goals and challenges.

A strong partnership

For more than 30 years, our senior partners with management experience have been understanding people, companies, and careers.

How the collaboration works

and offer

collaboration

Navigation

StartseiteÜber NewPlacement

Unsere Leistungen

FAQ

Blog

Standorte

Referenzen

Wiki

Presse

Genderhinweis

Datenschutz

Impressum

Outplacement Standorte